Business Expenses Include Sales Tax

This includes stationery pens pencils paper paper clips binders etc. One exception to this is client entertaining.

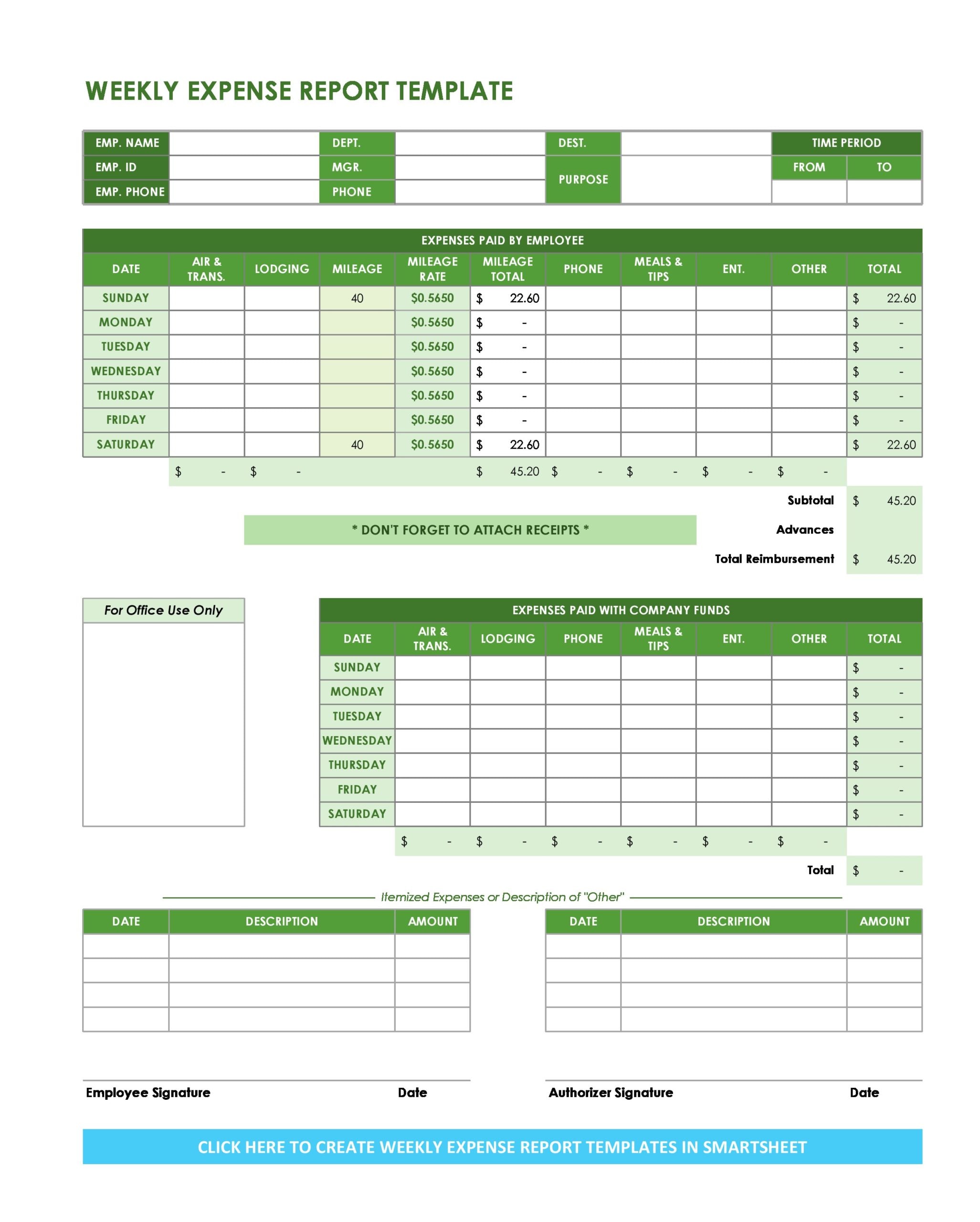

30 Best Business Expense Spreadsheets 100 Free Templatearchive

Generally your total expense for the purchase includes both the price of the item s and the sales tax.

Business expenses include sales tax. Business expenses are ordinary and necessary costs a business incurs in order for it to operate. To qualify as work-related travel your trip must meet the following conditions. But if you want to take this tax deduction you must include the amount collected in your gross receipts or sales on your business tax return.

The historic trend of revenue is analyzed and revenue for future periods is forecasted. Also since you cannot deduct personal expenses enter only the business part of expenses on Form T2125 T2042 or T2121. EBIT less interest expense is pre-tax income and pre-tax income minus taxes is net income.

Business costs that you as an entrepreneur can deduct from your income include. In effect this cancels out the tax deduction. Lease of business space.

However as a rule you can deduct any reasonable current expense you incur to earn income. Lastly when you buy a fixed asset which includes a sales tax. Real estate tax or property tax on real estate owned by your business but see below.

All expenses related to business travel can be written off at tax time including airfare hotels rental car expenses tips dry cleaning meals and more. In this case the sales tax is an expense not a liability. Examples of Sales Tax If a company sells 100000 of merchandise that is subject to a state sales tax of 7 the company will collect 107000.

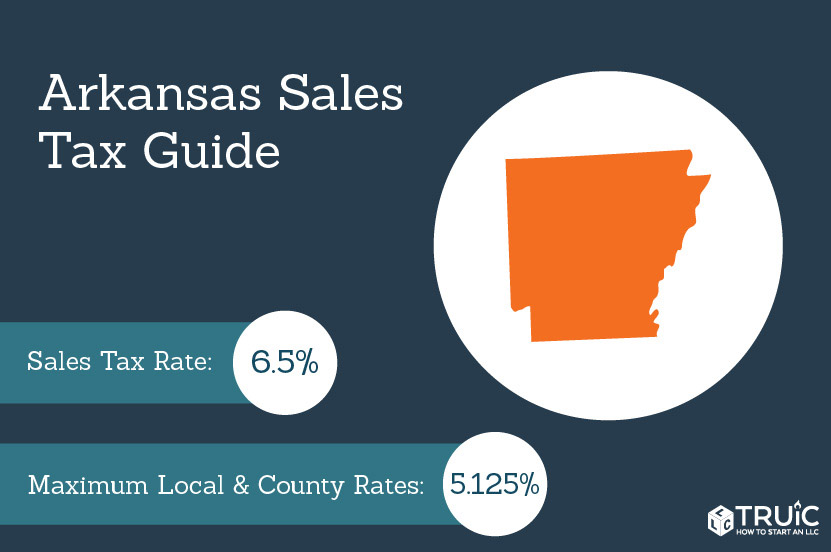

As a business owner or seller you are responsible for calculating collecting reporting and remitting sales tax to the appropriate state and local tax authorities. It charges the sales tax to expense in the current period along with the cost of the items purchased. Business expenses are deductible and are always netted against business income.

The journal entry to record this information is. Secondly as the first item on the income statement sales revenue is an important line item in the top-down approach of forecasting the income statement. Debit Cash for 107000.

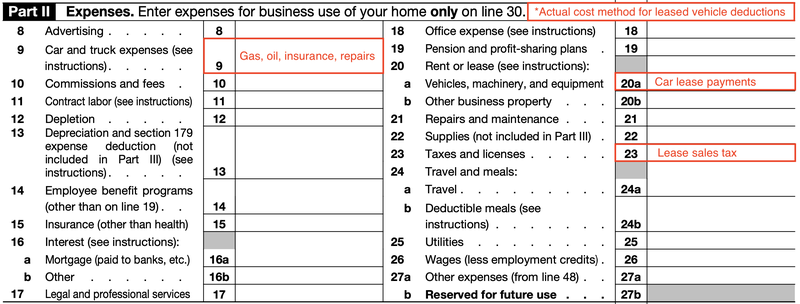

Any expenses incurred in the ordinary course of business. Line 23 of the IRS code says you can deduct state and local taxes imposed on you as the seller of goods If you collected the sales tax from the buyer You must also include the amount collected in gross receipts or sales on line one. Cost for stationery envelopes business cards etc.

Corporate travel expenses fall into the business expense category. Business expenses in the UK are items and services bought so that you can carry out the work of your business. The Tax and Customs Administration means business costs costs that are necessary within reasonable limits for the conduct of your business and that relate directly to your business.

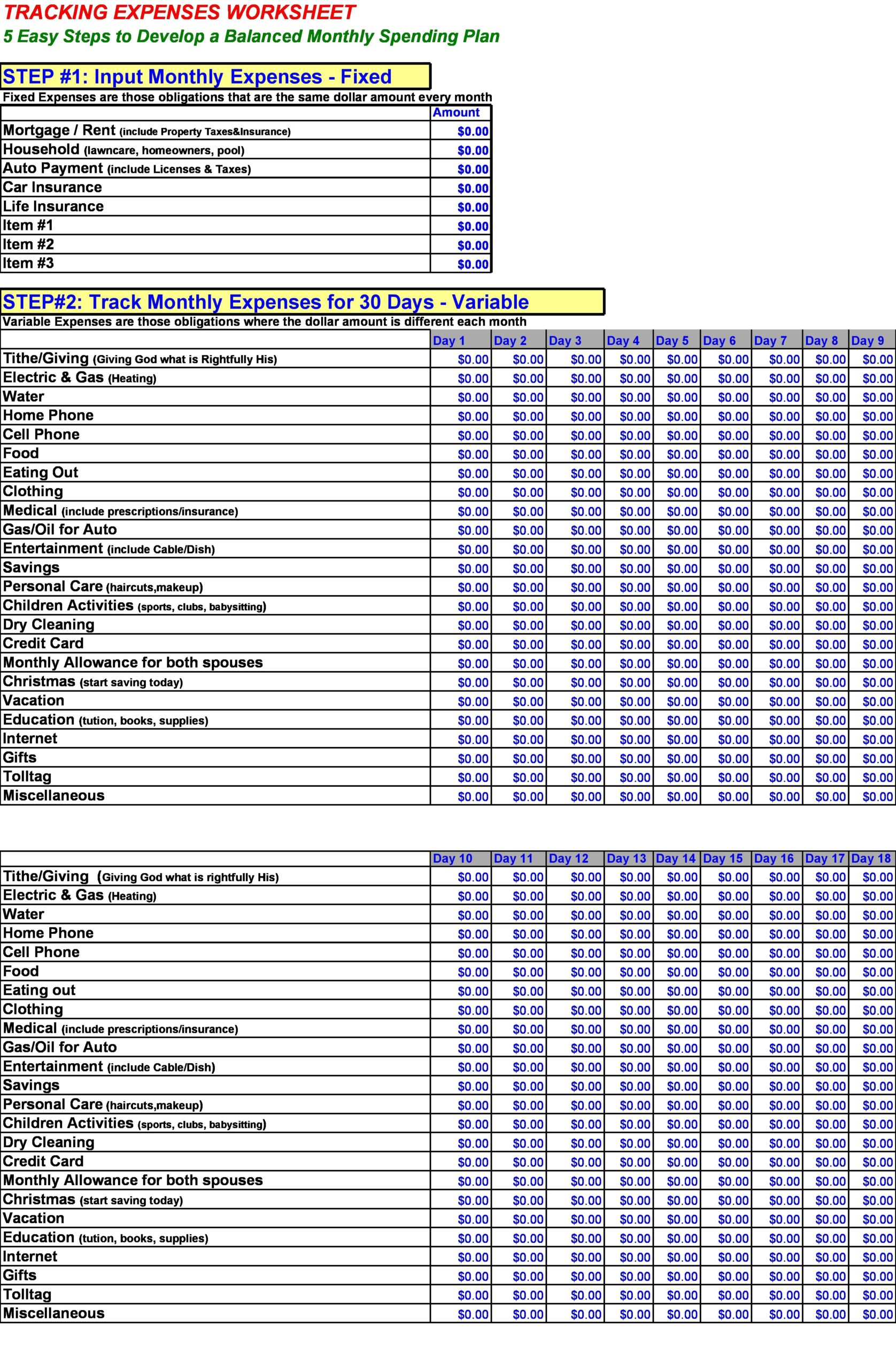

Decrease your Cash account and increase the corresponding expense eg Supplies account. Use tax is a tax that you have to pay if you purchased a product or service and did not pay any sales tax. You can deduct any supplies that are consumed during the duration of the tax year.

If you operate out of a home office you cannot deduct basic telephone line expenses. In this case it is allowed to include the sales tax in the capitalized cost of the fixed asset so the sales tax becomes part of. While its a valid business expense its not tax deductible and you cant reclaim VAT on it.

Common Business Deductions Supplies. The deductible expenses include any GSTHST you incur on these expenses minus the amount of any input tax credit claimed. Do I include sales tax collected from customers in my gross sales on schedule C.

Businesses need to track and categorize their expenditures because some expenses can count as tax deductions resulting in significant cost savings. The cost of goods sold is deducted from your gross receipts to figure your gross profit for the year. If you include an expense in the cost of goods sold you cannot deduct it again as a business expense.

Cost of goods sold is deducted from your gross receipts to figure your gross profit for the year. If you include an expense in the cost of goods sold you cannot deduct it again as a business expense. Some of your business expenses may be included in figuring cost of goods sold.

However business long-distance phone calls and separate business lines are. The following are types of expenses that go into figuring the cost of goods sold. You can reference the IRS website for a full list of deductible business travel expenses.

How To Write Off A Car Lease For Your Business In 2021 The Blueprint

![]()

A Small Business Guide To Business Expenses In 2021 The Blueprint

30 Best Business Expense Spreadsheets 100 Free Templatearchive

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Arkansas Sales Tax Small Business Guide Truic

What Is An Expense Report And Why They Re Important For Small Businesses

How To Charge Your Customers The Correct Sales Tax Rates

Instructions For Form 2106 2020 Internal Revenue Service

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Understanding California S Sales Tax

Free Excel Bookkeeping Templates

Top 25 Small Business Tax Deductions Small Business Trends

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time All About Planners Spreadsheet Income Budget Spreadsheet

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Https Www Irs Gov Pub Irs News Fs 07 17 Pdf

![]()

A Small Business Guide To Business Expenses In 2021 The Blueprint

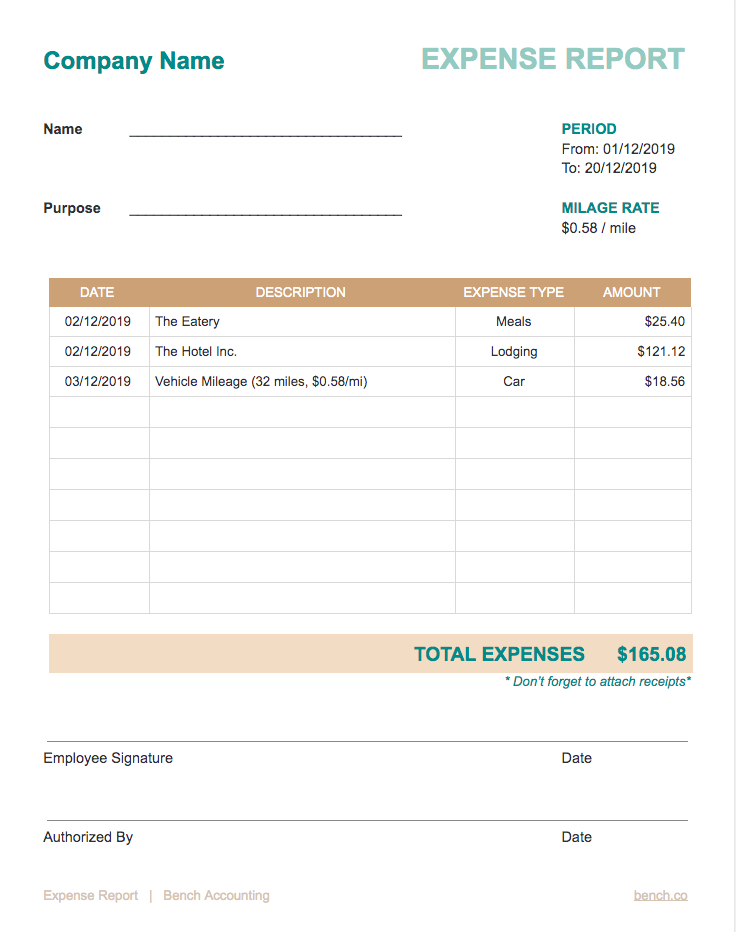

What Is An Expense Report Excel Templates Included Bench Accounting

Posting Komentar untuk "Business Expenses Include Sales Tax"